Save on travel expenses with our award-winning travel credit card

From hotels and car rentals to flights and more, get rewarded for the way you travel with our special travel rewards cards.

Travel card perks

Travel with valuable insurance

Shop the U.S. from anywhere

Earn more travel points

Experience more of the world with your travel points

Visit Marston Credit Rewards Centre in your internet banking dashboard to redeem the travel points you have earned for hotel stays, vacation packages, cruises, merchandise, gift cards and one-of-a-kind activities.

Featured travel cards

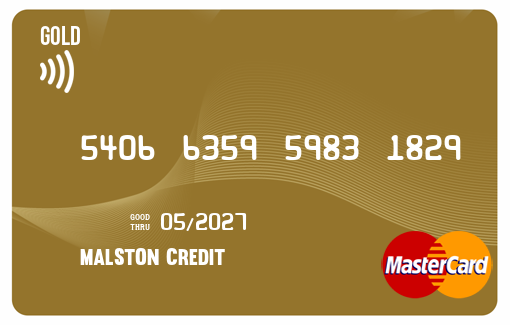

Marston World MasterCard ® Travel Card

Earn up to 7,000 bonus Earn+ points within your first year (that’s up to $70 towards travel).4

Earn 3 Scene+ points1 on every $1 you spend at Sobeys, Safeway, FreshCo, Foodland and more.

Annual fee:

$0

Interest rates: 19.99% purchases /

22.99% cash advances

Marston Gold MasterCard Travel Card

Earn up to $1,100* in value in the first 12 months, including up to 35,000 bonus Earn+ points and annual fee waived on your first supplementary card.‡

Earn 3 Earn+ points1 on every $1 you spend at Sobeys, Safeway, IGA, Foodland & Participating Co-ops and more.

Annual fee: $150

Interest rates: 20.99% purchases /

22.99% cash advances

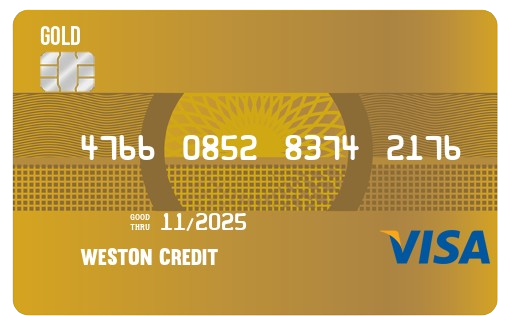

Marston Signature Visa® Travel Card

Earn up to $650* in value in the first 12 months, including up to 40,000 bonus Earn+ points.1

Earn 6 Earn+ points2 on every $1 CAD you spend in the United States of America at Sobeys, Safeway, FreshCo, Foodland and more.

Annual fee: $120

Interest rates: 20.99% purchases / 22.99% cash advances

Experience more of the world with our most flexible travel rewards program

Earn more travel points

If you want to earn points faster, choose a card that gives you bonus points when you spend on certain categories like gas or groceries — just make sure your top spending categories match the card’s bonus reward categories.

Compare key travel card features

You may want to consider features like annual fees, redemption flexibility and travel insurance. Don’t forget to check out the welcome offers too.

Consider the travel perks

Fly a lot? It may be worthwhile to get a card that offers free airport lounge access so you can relax while you wait to board your plane. Plus, some of our cards can help you speed through border crossings so you can spend less time in line when you travel. 5

Collect points now and travel later

Fly a lot? It may be worthwhile to get a card that offers free airport lounge access so you can relax while you wait to board your plane. Plus, some of our cards can help you speed through border crossings so you can spend less time in line when you travel. 5

Our travel rewards® credit cards can get you closer to your next vacation

From hotels and car rentals to flights and more, get rewarded for the way you travel and spend with our travel rewards® credit cards.

More to love about this card

Truly flexible travel

Fly any airline with points that don’t expire. Access personalized travel booking and trip planning with no booking fees through the Aventura Travel Assistant.

Share the travel perks

Other (secondary) cardholders can access travel benefits even when travelling without the primary travel rewards cardholder by linking their Aeroplan number.

Travel with valuable insurance

Get added protection when you’re away from home with Out-of-Province Emergency Travel Medical Insurance, Mobile Device Insurance, Hotel Burglary Insurance and Trip Cancellation and Trip Interruption Insurance.

You might also like

Gold Visa® Cashback Card

Earn 5% cashback on all purchases for the first 3 months (up to $2,000 in total purchases). Plus, get a 0% introductory interest rate on balance transfers for the first 6 months (22.99% after that; annual fee $0).

The only major bank that saves you 2.5% on foreign transaction fees.

Annual Fee:

Interest rates: